We are building a Coalition of Citizens & Minor Parties in Oregon to work towards a common goal of limiting Predatory Fiscal Policies and Endless Taxation by Lowering Property Taxes for all.

- As an example: a typical Property Tax bill might be $1000 for the County with an additional $850 going to the local School District. Your current $1850 Tax Bill would shrink by $850 immediately, and instead of your property taxes going up by $60 every year with no end in sight, your new tax bill next year would only be $1040. Making Home Ownership Affordable, while creating a little bit more revenue for the schools and counties from tourism and visitors.

By limiting Property Taxes from the current 3% Assessed Value Measure 5 and 50 Cap to a fixed 2% cap per year, and Implementing a Statewide (point seven %) Property Tax Levy or Offset on non-food purchases, we can fund schools without the risk of losing our homes. Tourism will play a big role in funding Public Schools , with the additional revenue from visitors to Oregon, and a savings for Oregonians who purchase less goods. We feel that Parents who send their children to Private Schools or who Home school, shouldn't have to put their family residence on the line to pay for public education, especially since their children will not attend government funded schools. Putting the state educational budget in the hands of consumers and tourists is a better choice for Oregon.

Declaration of Independence Oregon respectfully requests your assistance. You have the ability to work towards a solution that 98% of Oregon can get behind. We are seeking input from Oregonians on our draft of this new legislation.

Disclaimer: We do not allege to be Legal experts, but the time has come for action in Oregon regarding ever increasing Taxes of all kinds. The U.S. Supreme Court should be deciding the definition of unrealized gains, and the favorable outcome of this may force County Tax assessors to use your homes purchase price as the basis for property taxes, which is much preferred over some arbitrary market value, real or assessed. This would mean that the only way the property taxes would increase, is when you sell your home to a new owner. But in the mean time we would still like to bring relief to Oregon homeowners, in case the SCOTUS decides to avoid any future definition of unrealized capital gains as income or for property valuation.

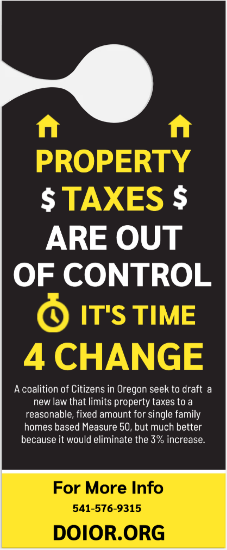

PROPERTY TAX FLYER

OREGON PROPERTY TAX AND SCHOOL FUNDING REFORM ACT